It has been over a year since I wrote a blog entry. Now that I’m starting to speak more freely about what I’m doing, John Regino wants me to continue to post on the ULISSES Project website in a “Founder’s Corner.” That said, the fact that the Super Bowl is this upcoming Sunday seems to make it the perfect time.

The short of it is Hal Tolley, Heather Claus and I started a new company and came to the Portland area to do it. My family goes back in the area for five generations and I myself left here only after high school. While many might think it a sentimental decision to return “home,” Heather made the analysis and determined that my home town metro was the best place to relocate for our new busines (on the WA side of the Columbia), with partners and potential partners right here or just up and down the I-5 in Seattle and Portland. More relevant for this discussion is how all this affects the ULISSES Project and how we got here. Here’s a bit of that “backstory.”

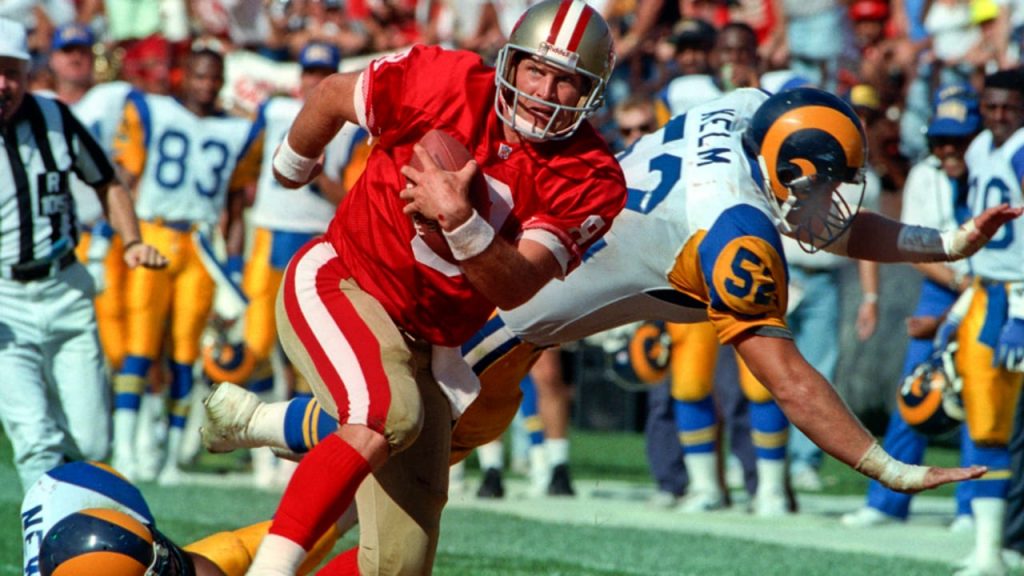

Montana to Rice transforms into Montana to Young

Last year I passed the leadership of the ULISSES Project to John Regino, then of MSCI. This move was logical, as MSCI had always been our biggest supporter and John our biggest advocate. He joined the University of Utah and I left. For several years John and I had played a “Montana to Rice” dynamic, but I knew that John could manage a “Montana to Young” kind of transition. For those of you who don’t know, Joe Montana was a legend at the San Francisco 49ers and worked with Jerry Rice to lead the 49ers to two Super Bowl victories. After that unbeatable duo, a guy from my alma mater in Utah, Steve Young, came off the bench to fill Montana’s shoes and did a great job, leading the team to another Super Bowl and himself to the Hall of Fame. John has “pulled off a Young,” doing a great job, and he should be announcing some major changes himself soon. At the time of our “on the field leadership change” he was with MSCI and it was the tail end of Covid, an event that had brought challenges and opportunities, something I now refer to as “the Covid Pivot”

The Covid Pivot

Before Covid, we were looking forward to generous funding for a university-wide project and working with one of the world’s foremost computer scientists. Within days of the Covid Crisis unfolding, I was informed that the funding and the computer scientist himself were being diverted to Covid-related issues. The program was literally grounded one day before we were to board planes for London to explore partnerships (the University of Utah canceled all official travel the day before we were to board planes).

It was a time when everyone had to pivot, just like happens when a QB is ready to pass, and then finds he has to run straight into the maws of the defense to move the ball forward. We had previously had companies visit us on campus and make offers, which we’d politely declined, deciding to keep everything in an academic setting. Then with funding drying up, we scrambled and dialed the same people who’d made the offers. We found each group in crisis themselves, politely turning us down and then asking us to call back when things “normalized.” Eventually, an opportunity opened up, just like it does for a good QB when he can’t be taken down.

Before Covid, an Indian data analysis company’s CEO and COO had flown out to Utah and after reviewing our preliminary results, had offered to make their entire extremely exclusive 12-year database of complex data available to us so we could experiment on it. You see, they had compiled all their data “by hand,” with an army of highly educated and experienced analysts reconciling vast amounts of investment bank information. They were looking for a way to automate their systems because five of the world’s largest investment banks had just formed a “consortium” that had started by hiring over 300 of their employees and the head of one of their divisions. They had spent years training these analysts and then, in one hit, 300 were taken out, moving to a new company offering twice their salaries with the express objective of putting their old employer out business.

I was extremally excited about the project because this not only tied into my dissertation, but it was the direct continuation of a project Barr Rosenberg had started almost 40 years before. In that project, Barr created the greatest database of investment bank forecast data in history, which was then copied and effectively ruined by investment banks. I know that because during my dissertation I worked with the highest regarded company that had copied and commercialized that process. I know this also because I fixed errors in their data every night, errors that academics just assumed were not there. It was largely because of that work that I won the data company’s International research prize…then I applied my findings in industry, at the very place where Barr had initially done his work. Among my first projects applying my dissertation research was one overseen by a woman who’d eventually become my partner in life.

Manual Reconciliation of Complex Data

My wife was hired to restart Barr’s reconciliation project, being assigned to a failing Japanese equity group. The genesis of the project was when Barr Rosenberg and his small group of consultants had been asked to systematize the collection and reconciliation of complex data from investment banks for Wells Fargo investment division (that later became Barclays Global Investors). That project, facilitated by a bunch of Fortran code and skilled human analysts had never been equaled since. In fact, it’s results would have been lost to history if it had not been immortalized in an American Accounting Association Monograph and related to me by my Ph.D. program director, Barr’s student. Other companies and groups within investment banks were formed to replicate Barr’s results, but none could equal them. Crazily, after Barr and his team finished their work, a few years later some administrators cut the internal project because they found they could get “most of the results” by outsourcing. “Most of the results” in investment management is what administrators who’ve never invested think is good enough in a game won by inches and yards, not miles.

Heather’s team were tasked with taking a portion of my dissertation code and building a new reconciliation system. In retrospect, it was pretty rough code, but from it she built this beautiful system by doing things like working with the banks collaboratively. When my team did the analysis of the new Japanese systems, we found the new system was better than Barr’s original and that roughly 50% of the performance came from computer code and 50% from her improved data. Amazingly, history repeated itself again and the project was shelved when both Heather and I got married and left for a new adventure in London–administrators again thinking “almost as good” was good enough. This after that very system had lifted the Japanese equities group from bottom decile performers to top decile performers. In other words, often administrators in investment management substitute crisis management for management, and when the crisis averted that meant that they could now cut costs and destroy what had saved them in the first place because for at least a year they’d be able to pay larger bonuses, mostly to themselves for such “innovative cost cutting measures.”

Because of her history coordinating the reconciliation project, Heather was the perfect ambassador to the CEO and COO of the Indian company when they visited the University of Utah campus. During their visit, somewhat off the cuff, I said our technologies could automate their processes, freeing up hundreds of their employees’ time. The COO had remembered my comment and she contacted Heather during Covid and they negotiated a “no strings attached,” million-dollar contract to see if we could do just that. They really had no choice. They had hundreds of employees reconciling mission-critical data for the world’s top hedge funds and most of those employees could now not get into the office where they traditionally did their very sensitive work. The COO trusted that Heather and I knew what we were doing because we’d done it before. Just like that, the “Covid Pivot” pulled us in.

Complex Information Processing and AI

When Covid hit, we had already finished proving that our technology could predict changes in forecasts of the majority of human analysts (or in other words, it forecasted better than half the experts consistently). Our technology worked especically well in complex, “non-normal” situations. We believed that this was our big innovation, but the COO of the Indian data analysis company and Heather understood that the real big innovations were the tools we had developed to conduct complex data reconciliation into complex forecasting models. This idea was always known by early AI pioneers such as Herbert Simon, who referred to the entire field of AI as “complex information processing.” The “Big Lie of AI” is that while there are scores of open-source AI tools for simple information processing, no one can currently process complex information other than by utilizing armies of human analysts.

The fact that most AI progress rests on bed of human labor, is not unlike the Matrix relying on human “copper tops” to fuel the Machine Empire. I’d often mentioned this in private and had pointed out that one of the purposes of the ULISSES Project was to free up the humans for more creative endeavors, and this was the opportunity to prove what I’d said. While we had previously processed complex information, up to this point my team at the University of Utah had only reconciled 4 standardized sources. This was something much larger, with hundreds of data sources requiring reconciliation. Furthermore, we were going up against the best human reconciliation experts on the planet…could we really beat them? In other words, it was like we went from playing college football to the Super Bowl.

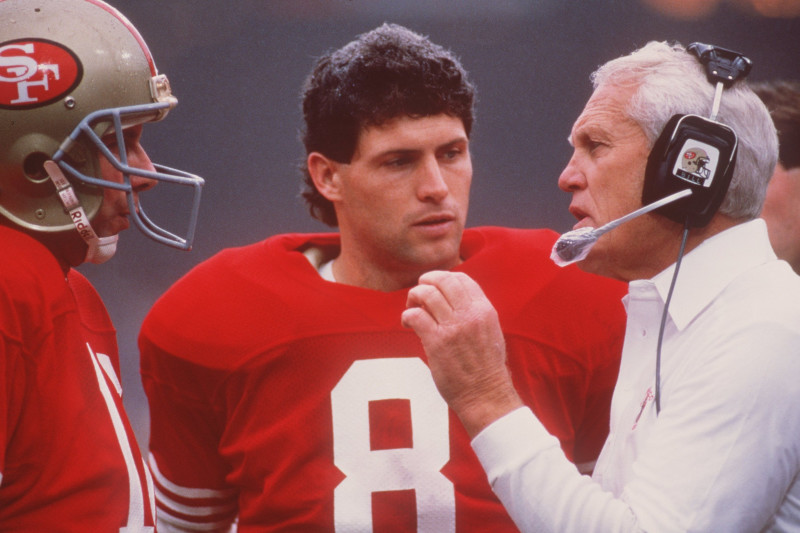

Bill Walsh and the 49ers

The football analogy wasn’t too far off and it’s the right time of year for it, with the Super Bowl fast approaching. Bill Walsh had a strategy (like a new technology), called the West Coast Offense. The head coaches in the NFL wouldn’t let him run it, so he went back down to Stanford University, perfecting his “science.” There in the heart of Silicon Valley, a place known for innovation, after a level of success in applying his technology in the “university lab,” he came to the attention of the owner of the 49ers who was willing to give him his shot, as head coach and general manager of an NFL team.

After some rocky first steps, Walsh’s team started winning. His teams and methods won Super Bowl after Super Bowl, making names like Montana, Rice, Cross and Young immortal in the NFL, and Walsh is also considered himself one of the greatest coaches ever. Everyone saw they had to adapt or die, so it changed the game to adopt his methods. More important than that, it gave kids like Heather, a poor kid from Santa Cruz, hope. She and her friends had seen the 9ers down in the dumps and then they saw–really lived–the ascension from bottom of the NFL to the very top. The change came not by just throwing money at the problem like the big banks do (and never seem to solve their problems), but by being smarter, never giving up on what he knew was right, and having a united team. It’s worth noting that when the 49ers won their first Super Bowl under Walsh’s leadership, they had lowest payroll in the NFL. Brains, grit and teamwork for the win.

On a personal note, when Heather, and I met at the largest institutional investor in the world in San Francisco, the 9ers were one of the things we had in common. For me the 9ers loomed large because I played high school football on the West Coast, and the 9ers filtered down to weird things like my coach making me an offensive lineman in high school despite my relatively small size because he new I’d protect the quarterback with my life (really my knees, that’s what gave first). Heather got it because to her, guys like Randy Cross (guard) were heroes that protected the QB from monsters like LT, “The Terminator.” She said watching a team like the 9ers “elevated everyone.” Not a bad model to have driving your effort.

Academic Project to the NFL- Game Time

Our “Covid Pivot Project” was reconciling over 200 data sources to a common model and taxonomy, both of which our systems defined by devouring billions of data points. Scarcity became the mother of innovation. For example, not having the money to burn on the cloud in our earlier work, we cobbled together and ran servers locally in Utah in a hybrid-cloud. If we had not done this, the problems that cascaded during Covid would have flowed to us, but instead, we could just go to our servers in downtown SLC and fix things ourselves, sometimes even cannibalizing parts from idle servers to keep them running (in addition to saving tons of money in the process.)

The hybrid-cloud solution worked so well that it transformed our clients’ underlying business. Soon “no strings attached” turned into an aggressive offer by the CEO for our codebase “so they could utilize our innovations firmwide.” While flattered, decided to follow the flow of the Covid Pivot. The question came to a head when a manager at a $100+ billion fund offered us backing to manage a new hedge fund if we simply “shared the technology with them.” We’d technically own the new hedge fund and all we’d have to do was share our technology with our backer. The subtext is it would be an exclusive share. In other words, we couldn’t share it with others.

It was a crossroads. Luckily, two men I respect had already been faced with this same decision and made vastly different decisions. Both men are applied mathematicians, both about at my age when they made their crucial decisions and, strangely, I share the same first name with them–“James.” We used these men as our guides, and I’ll relate that decision next week and convey how I expect it to impact the ULISSES Project going forward.