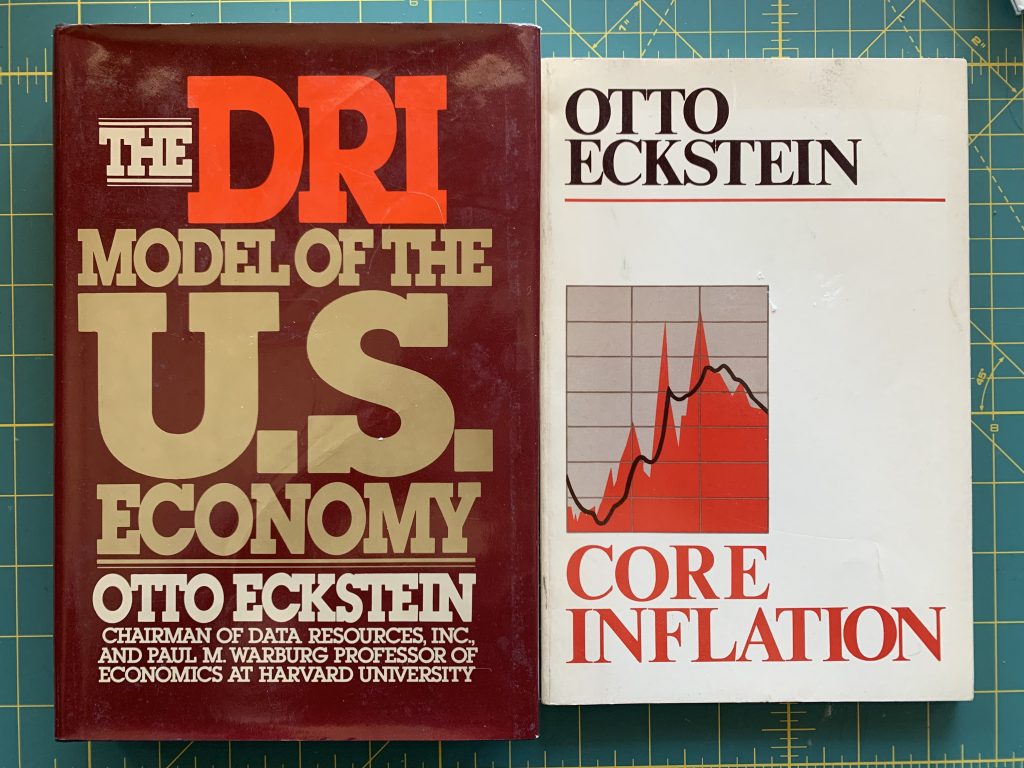

I had an interesting conversation today with the head of the C. Kem Gardner Institute, which is a group here in Utah that has some of the best state macroeconomic statistics of any state in the nation. Natalie Gochnour, its head, and her team is an impressive group. They are doing some exciting work across the state of Utah, powerfully communicating meaningful statistics in a way that affects change in a positive way. We will begin exploring ways to work together, something which I think is almost inevitable considering the underlying technology building blocks of the ULISSES Project, my interest in macroeconomic models, and my desire to aid my local community here in Utah. For reference, I’m a big fan of Otto Eckstein and DRI, a man and group that has done more than a little in influencing me. This said, I should give a little context.

DRI versus WEFA for the World

Columbia University Press called the first significant commercialization of financial technology “the Datawars.” In short, what happened is Harvard professor Otto Eckstein focused on collecting and making a massive set of financial technologies available to the world via the company Data Resources Inc. (DRI) that he built with the backing of Wall Street legend Donald Marron. DRI not only provided consolidated computer processing (much like today’s cloud), but it also had its own custom technologies such as a highly developed context-specific language, early databases, and robust financial models, all integrated with the best macroeconomic data on the planet. These services were all made available to the government agencies, companies, and investment firms for a fee and provided to universities for free. This was an amazing idea, way before its time. Other groups such as Wharton Econometric Forecasting Advisors (WEFA) led by Nobel Prize winner Lawrence Klein tried to compete, but even with the help of the United Nations and the governments of France and Germany, WEFA could not go the distance with DRI. There was a time when every government agency, every large corporation’s research department, and all macro investment firms subscribed to DRI—it was the first research “must-have,” kind of today’s ubiquitous Bloomberg Terminal.

Top-Down versus Bottom-Up Modeling

I say that it was an idea that was way before it’s time because DRI’s models (and WEFA’s for that matter) were all top-down, something that would be awesome if the economy actually worked as our professors tell us it does, an idea we are disabused of the minute we get hit in the face with the cold fish of reality. In the real world, we and even the professors that teach us know that these models are meant as didactic tools to convey ideas, not something that’s intended to replicate the world (for an interesting explanation of this I highly recommend reading Mary S. Morgan’s The World in the Model: How Economists Work and Think). This deviance of top-down models from bottom-up reality was the reason that no one really won “the Datawars” (in deference to comedic and horror genius of the Brooks’ family, I will hereafter refer to it to “World War D”). That said, a lot can be gleaned from studying how both DRI and WEFA dealt with the problems of modeling economies and variables like inflation.

As much as we know that economies don’t work in a Top-Down manner (except in Communist commanded economies, which do not work), what DRI and WEFA did at the time was justified because it was the best that could be done with the technology that existed at the time. Even calculating something like MIT’s real-time inflation calculator, The Billion Prices Project, that is relatively trivial now forms a technology perspective today which would have brought DRI or WEFA’s systems to a standstill–and it also would have handily outperformed Eckstein’s “Core Inflation” Model. We simply have better technology and better tools today so we can start restructuring problems by bringing a full set of tools to bear on the problem. It is in fact by looking at DRI, and taking umbrage to what Otto Eckstein et al. did in their own modeling framework, that I came to the modeling solution that we are using today. It’s kind of like Plato pointed out in The Republic, if you want to figure out something “go big” and then apply it down. Fortunately, financial accounting for a company, and an economy, are very similar mathematically.

Restructuring Data with an appropriate Modeling Framework

Just like in the movie World War Z , the war was won by understanding that one needs to stop fighting the zombies and restructure the problem, turn it upside down. Doing so helps us figure out that the solution was there, always staring us in the face. In World War Z, it was actually our frailty as human beings that was the solution. Similarly, hidden in our “weakness” of not being able to top-down model our infinitely varied capitalist world is an amazing strength, if we can assemble and appropriately model the data in a bottom-up way that can allow the solution to naturally emerge from the facts. I’m excited about the possibilities of applying the technology and the methods we’ve developed for the stock markets to the broader economy. This idea of making a real difference in the world as we go into more turbulent times is a lot more credible than Brad Pitt and the United Nations saving the world through their research acumen (he’s a lot more plausible as Tyler Durden…respects to Zero Hedge).

With this said, we look forward to applying what we know to these problems in the next World War D!