I’m writing this on the plane back to Salt Lake from New York and based upon some conversations that I had, I thought an entry on artificial and augmented intelligence was merited. In the last few years, AI and Machine Learning have been much ballyhooed in finance. Let me just give you a few examples. Bridgewater paid $20 million to license Watson and actually hired quite a few of IBM’s team. This was in addition to IBM quietly doing projects with both Citi and Morgan Stanley looking for a holy grail project in which Watson could be turned from game shows to gaming the system. Other projects in the FinTech AI/Machine Learning area include the massive efforts by groups like Credit Suisse, JP Morgan Highbridge, and Tudor.

The Current Impact of AI in Finance

So other than my day job, I do things like travel around the world with my students introducing them to important investors and other people in the market. It’s actually one of the most enjoyable things with university involvement. Here is a picture of me with some of the U’s best and brightest at DE Shaw, a legendary New York hedge fund started by former Columbia University Computer Science Professor David Shaw.

Anyway, when we started our week in New York for this very trip above in the last months of last year, we had a kick-off with Gretchen Morgenson talking to my students (there were a lot more of them than in this picture). If you haven’t heard Gretchen speak, I highly recommend attending one of her talks if you ever get a chance. She is known for being one of the best-connected journalists on The Street. With this great opportunity in front of them, one of my students boldly asked: “What is the real impact of all this AI in FinTech?” Gretchen stated quite clearly that “despite all the media attention, without an exception, not one of these projects has worked out as planned and made a material contribution to the businesses of the financial companies involved.” So why do these people, some of the smartest in the business, keep investing and more importantly what do they hope to gain?

My first Chess Teacher

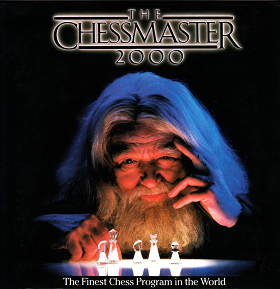

I start by going back in time to when I was a kid. My big brother was a beast at Chess, beating me regularly. That happened until I met my first Chess Teacher: Chessmaster 2000.

Chess was my big brother’s bastion, something that he could always beat me at and he was never going teach me anything as he was determined it would never be a fair fight. While we had our fistfights, he always used Chess to really school me. He spent all of his spare time reading books on chess while I spent all my free time on a computer. He always wanted to prove that he was smarter than me and he used Chess to prove it. I never thought this was going to change so I pretty much resigned myself to never being able to stand up to him.

I lived avoiding the Chess table in our house. Then, one day when I was at Egghead Software (yes, we used to actually have stores that sold us software), the manager who I knew well (and who knew about the abuse I suffered at my brother’s hands) told me about the best chess game he’d ever played. I wasn’t initially interested but then he explained to me how it could tutor me. I liked the idea and decided I would take a chance and bought the game. Thereafter, whenever I was taking breaks from coding I’d turn to Chessmaster 2000 in secret.

After months of practice involving hundreds of hours, I set up the chess pieces on our table and waited nearby. It didn’t take long and I was challenged to a game by my nemesis. Within minutes he knew something was different. While I drew it out to savor the victory, within minutes I knew I was going to win and so did he. What I, and my brother, found out when I was in high school was what world chess champion Garry Kasparov would report to the world several years later. It was my story, and Kasparov’s, that tell why those very smart people in hedge funds are not being deterred by the early failures in AI/Machine Learning.

Computers can help Augment our Intelligence, not Substitute for it

Simply stated, the future will belong to people who know how to use tools correctly, or in other words to people that will augment their intelligence instead of relying on machines to think for them. I’m far from the first person to say this, as it has been stated by people ranging from the head of IBM’s Watson to David Seigel, one of the founders of Two Sigma. This result will manifest itself in investment management much the same way that it has in all kinds of other areas. Garry Kasparov, said it best when he related these results from hybrid or open chess tournaments, something I will discuss in my next blog entry.